While property and casualty insurers may be at varying maturity levels across their cloud journey, one thing is clear: Cloud computing is here to stay. As carriers migrate to the cloud, core systems vendors are working to ensure that their customers have as smooth an implementation as possible.

Guidewire, one of the most well-known core systems providers in the P&C industry, is one such vendor that has shifted to a cloud-first framework. Its Guidewire Cloud solution, hosted on AWS, is available for InsuranceSuite customers, offering faster, less disruptive software upgrades and easier implementation of new features and capabilities. Guidewire also manages IT issues for customers on Guidewire Cloud, leading to time and cost savings.

Given that Guidewire is constantly adding new features and capabilities on its cloud-hosted versions, a growing number of insurers are turning to Guidewire Cloud to modernize their core systems. In fact, earlier this year, Guidewire announced that it will be offering three cloud releases annually to ensure customers have access to the latest capabilities even earlier. Despite this change, Guidewire remains committed to providing ongoing support to its on-premises and self-managed versions for the foreseeable future.

While cloud deployments have become commonplace for insurers over the last several years, we still encounter carriers with questions about what to expect from a Guidewire Cloud implementation. Here are answers to some of the top questions our team is asked by Guidewire InsuranceSuite customers who are in the process of or are considering moving to Guidewire Cloud.

Answers to Insurers’ Top Questions for Upgrading to Guidewire Cloud

1. What is Guidewire Cloud?

As most insurers likely know, Guidewire Cloud is a Software-as-a-Service (SaaS) platform hosted on Amazon Web Services (AWS). If you haven’t used Guidewire Cloud before, however, you may not know that it is specifically designed to be used with Guidewire InsuranceSuite core applications to streamline insurer activity across the entire value chain. It includes cloud-native services, configuration tools, common data models, embedded analytics, and open APIs. Based on a hybrid-tenancy model, Guidewire started distributing its platform as a cloud service in 2019.

2. What are the advantages of Guidewire Cloud?

The Guidewire Cloud ecosystem has been optimized for Guidewire’s entire software ecosystem, meaning that upgrades and new features are rolled out to insurers quickly and without friction. This reduces IT complexity and allows insurers to consistently leverage the latest Guidewire capabilities to drive business benefits. Rolling these changes out on Guidewire Cloud also simplifies the process of maintenance, implementation, and upgrades for insurers. And given Guidewire’s move to three releases each year, it has never been more critical for upgrades to be a seamless process.

As with other cloud platforms, running on Guidewire Cloud helps insurers save on infrastructure and operational overhead costs, shifts the onus of application security onto Guidewire, and improves on carriers’ disaster recovery plans. All of these benefits are part of why cloud optimization is a top priority for insurers.

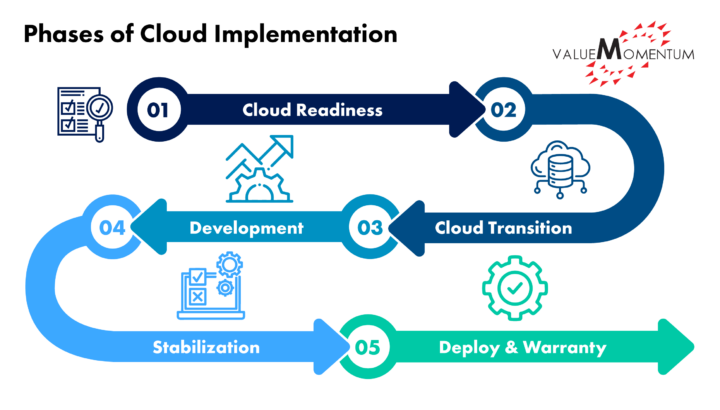

3. What are the phases of a Guidewire Cloud implementation?

As with any cloud implementation, timelines are determined by the specific requirements of each engagement.

A typical Guidewire Cloud implementation can be broken down into five phases: Readiness, Transition, Development, Stabilization, and Deployment and Warranty. This phased approach is intended to help customers meet their strategic goals and maximize their cloud investments.

The breakout of the phases is below:

The Readiness stage begins with a pre-work assessment to examine the current technology setup and the best course of action for the insurer. Guidewire uses its SurePath methodology to guide customers through the implementation process. It will conduct a cloud workshop evaluation, providing an indicative cloud upgrade estimate (CUE), a proposed timeline, and a suggested release plan. We also recommend reviewing the technical findings from a cloud optimization backlog. Completing the Readiness stage can take a typical insurer anywhere from 1-4 weeks depending on the size of the organization.

The Transition stage starts with technical upgrades and the initial code merge. Once that has begun, it is time for the infrastructure setup on Guidewire Cloud. In addition, during the Transition phase, Guidewire defines a program roadmap and develops a cloud deployment strategy based on the carrier’s needs. It is also beneficial to define a list of key functions and workflows, create a conceptual sprint plan, and propose a testing strategy. Completing all of the components of this phase can take, on average, anywhere from 3-4 weeks.

The Development stage includes many steps: cloud optimization and remediation, refactoring development requirements when necessary, upgrade validation, test plan development and execution, and validating and demonstrating key workflows. An early systems integration test may be performed where appropriate. In most cases, this stage can take anywhere from 2-4 months.

The Stabilization stage is where end-to-end system integration testing (SIT) and support user acceptance testing (UAT) are performed. This is the part of the process where the deployment plan is finalized, users get trained on the system, and there may be an upgrade dry run. This stage usually lasts 2-4 months.

The Deployment and Warranty stage is where, of course, deployment is executed. On top of that, though, a post-production support plan is created along with a cloud data access strategy. Warranty support is also provided. This usually lasts one week to a month.

4. How do I maximize the value of my investment in Guidewire Cloud?

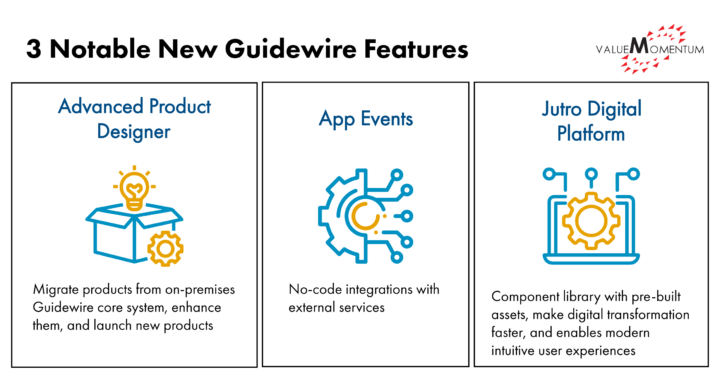

As noted above, Guidewire is continuously adding new features to its platform and is providing three update releases per year. Three of the most notable features that have been added recently are Advanced Product Designer as a cloud app, App Events/Integration Gateway, and Jutro Digital Platform, all of which are rooted in the concept of providing a low-code/no-code experience for insurers. With Advanced Product Designer, insurers can migrate existing products from their on-premises instance of Guidewire core systems and enhance them, or they can launch entirely new products more easily than in previous deployments.

Similarly, App Events enables no-code integrations with external services like chatbots or damage estimate service providers simply by indicating which events should lead an interaction to that third-party platform. The Jutro Digital Platform offers a component library with pre-built assets to help make digital transformation faster and enable modern and more intuitive user experiences.

5. How can I ensure a smooth transition to Guidewire Cloud?

Utilizing a phased approach for evaluating all parameters to align with Guidewire Cloud standards, infrastructure, and architecture will help avoid any hurdles during implementation. This includes reducing reliance on legacy systems, simplifying the IT landscape, and limiting customizations to out-of-the box functionalities, which could lead to code quality issues and violations of coding best practices.

It’s also vital for the current application(s) to be maintained in compliance with the core product with minimum deviation, which will reduce the effort required to upgrade to the latest version of the cloud offering. Guidewire has built-in recommendations and guidelines to ease the process. Following Guidewire’s recommended reference architecture to redesign existing interfaces and using Guidewire SurePath guidelines and standards to develop new interfaces and functionalities will positively impact the migration journey.

Additionally, cleaning up technical debt by refactoring the code to align with Guidewire’s best practices and SurePath methodology will boost application performance and stability while providing a clear path for any future upgrades.

6. How can I gauge my organization’s level of readiness?

For insurers considering upgrading to Guidewire Cloud, engaging with Guidewire and an SI partner to perform a Cloud Transition Assessment and Cloud Readiness Workshop will give you an idea of your organization’s level of readiness. This assessment will look at your needs for configuration and integration. As part of the assessment, Guidewire will publish a “mandatory terms” list covering the readiness activities prior to initiating upgrade. The transition assessment and the mandatory terms will give you an idea of what is needed to prepare your organization for an upgrade to Guidewire Cloud.

For insurers considering upgrading to Guidewire Cloud, engaging with Guidewire and an SI partner to perform a Cloud Transition Assessment and Cloud Readiness Workshop will give you an idea of your organization’s level of readiness. This assessment will look at your needs for configuration and integration. As part of the assessment, Guidewire will publish a “mandatory terms” list covering the readiness activities prior to initiating upgrade. The transition assessment and the mandatory terms will give you an idea of what is needed to prepare your organization for an upgrade to Guidewire Cloud.

Other components of this assessment include a CUE report, which will provide an indicative estimate for technical upgrade and a list of cloud optimization backlog items that have to be addressed. A trusted SI partner can help insurers fully understand all of these findings before starting any cloud implementation work. At ValueMomentum, for example, we provide a pre-cloud remediation process that allows insurers to feel confident that their implementation approach is customized for their organization’s needs.

ValueMomentum is a Guidewire PartnerConnect Consulting partner at the Select level and has achieved several Guidewire PartnerConnect specializations, including ClaimCenter, Cloud Ready, and InsuranceSuite Integration for the Americas region (AMER). In Guidewire’s September 2023 specializations update, ValueMomentum was one of ten Guidewire PartnerConnect Consulting partners awarded new specializations. We received Guidewire specializations in PolicyCenter – AMER as well as in Technical Upgrades.

7. How do I secure the cloud?

Cloud providers are responsible for securing data and applications on their platform, and Guidewire Cloud is no different. Guidewire Cloud offers third-party compliance programs and certifications to ensure your customer data is safe, secure, and aligned with industry standards. These programs safeguard servers, storage, applications, and data.

Even though Guidewire provides the necessary security for the data and applications on its cloud platform, it is still industry best practice for insurers to have a framework for enterprise cloud security. This allows insurers to establish controls across their organization to protect their data and assets.

Speed is imperative in the digital age. The ability to leverage the most recent version of core applications and seamlessly launch new features and tools can be a competitive advantage for any insurer. Upgrading to Guidewire Cloud can enable insurers to maximize the value of their core investments.

To learn how you can assess, plan, and strategize your Guidewire Cloud upgrade journey, check out our Core Upgrade services.