Rapid technology advancements are reshaping many industries, including insurance and financial services. These advancements are allowing enterprises to improve their operations and enhance the experience and services they provide to their customers. Within insurance, a major technology advancement in the last decade is the modernization of core systems. At this point, many insurers have already completed, or are almost done with modernizing their Policy, Billing and Claims systems.

In addition to upgrading their core systems, forward-looking insurers are embracing core transformation – focusing their attention on evolving their core systems to meet changing market demands. However, core transformation not only changes how insurers adopt, deploy, and maintain their core systems, it also introduces new types of risks into any or all phases of a core system’s development life cycle.

To mitigate risks and minimize associated costs, insurers must shift towards a dynamic and ongoing Quality Assurance (QA) and Quality Engineering (QE) strategy throughout the development life cycle. Testing complex systems can no longer be considered a development afterthought.

How should an insurer proceed with core transformation and ensure the accuracy and performance of their core systems? What are the trends and best practices being adopted in the industry?

Key Trends Impacting Core Testing

Aite-Novarica reports that 60% of mid-sized P/C insurers have already engaged in core systems transformation and are modernizing their QA capabilities in tandem to support their core transformation. Some QA /QE trends that are impacting how insurers test and validate their core system implementations are:

- Rising Volume and Complexity of IT Projects. To compete in the digital market, traditional carriers face the need to quickly roll out new products and services, embrace new distribution channels and technology platforms, and expand their data sources. They also face the need to digitalize, streamline processes, and apply AI and analytics to derive insights from data.These business needs have spurred insurers to develop more complex core systems and a greater volume of application rollouts. As new technologies such as AI and machine learning revamp validation techniques and predictive modeling, traditional QA testing at the end of a product cycle is becoming obsolete. Now, insurers must utilize testing automation to incorporate testing at each step of the cycle along with continuous deployment and integration. A sound QA/QE strategy will leverage AI and adopt continuous testing and validation of core systems/processes throughout the full development lifecycle.

- Increased Use of Microservices Architectures. APIs and microservices are increasingly necessary to enable the IT applications needed to succeed in today’s ecosystem-driven marketplace. Adoption of APIs offers insurers an opportunity to participate in the digital ecosystem, forge new partnerships, create new business channels and deliver more value to the customer. However, microservices architectures that use APIs require more moving parts, which comes with innate points of failure and potential security vulnerabilities—all of which need to be thoroughly tested and validated. As more insurance core systems become cloud-native and utilize SaaS architectures, insurers will be at an advantage to engage in continuous API testing as part of their QA/QE strategy.

- Constrained Testing Windows. Modern software development practices have changed drastically in recent years. They now rely on adopting Agile and DevOps methodologies that embrace continuous integration/continuous delivery (CI/CD) at every step of the cycle. They also involve combining microservices to build new solutions instead of developing everything from the ground level.These practices significantly accelerate time-to-market for new products and capabilities, helping insurers progress from the industry’s traditional twice-yearly releases to multiple releases every day. However, this reduces the overall time allowed for testing and validation. Continuous testing then becomes even more vital to release applications that perform as intended and reduce the potential risk of failure.

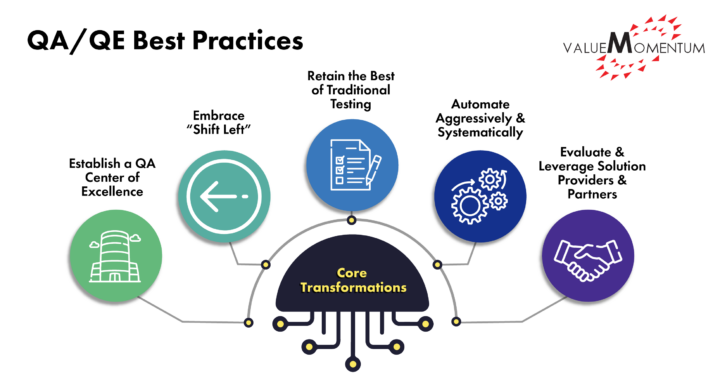

QA/QE Best Practices for Core Transformation

Successful QA/QE modernization in insurance requires a shift in mindset. QA can no longer be treated as a defect management function that’s relegated to the end of a development cycle. Rather, insurers must consider QA as a strategic standard, implementing the following best practices to ensure customer satisfaction and operational efficiency:

- Establish a QA Center of Excellence to create a quality-oriented culture throughout the enterprise. Insurers can take these critical steps to establish a QA CoE: 1. dedicate QA resources right at the project’s inception, 2. conduct software testing whenever possible, and 3. establish feedback loops to share testing results with developers, business analysts, project owners, and any others associated with the project.

- Embrace “Shift Left” is now SOP in the software development at large. The longer a project progresses, the more expansive, costly, and challenging the errors are to resolve. Shift Left as a practice initiates testing as early in the development lifecycle as possible to address and fix such errors continuously and quickly.

- Retain the Best of Traditional Testing to maximize QA processes and outcomes. This includes, but is not limited to, adding technical expertise to QA teams, incorporating test automation into project definitions, and building dedicated performance and security testing teams.

- Automate aggressively and systematically. Test automation can solve the need for continuous testing under constrained time frames. To reap its benefits, insurers should prioritize test automation based on strategic goals and organizational readiness. This includes automating all forms of testing, including build verification and smoke and regression tests, which require multiple tools. Over time, the tools-to-be-used can be further standardized.

- Evaluate and Leverage Solution Providers and Partners. These professionals may already have the honed expertise and advanced test automation tools required for QA modernization. Insurers must assess these providers’ quality of tools and technologies to see if they match the culture the firm wishes to build internally—the merge of both culture and technology are critical to achieve QA modernization goals. Insurers must also ensure that solution partners are rigorously measuring their own quality. Thus, insurers can have access to data that demonstrate continuous quality evaluation and evolution.

Implementing Change

A dynamic QA/QE strategy serves as a significant differentiator to achieve core transformation success. Ultimately, insurers can implement these best practices to gain competitive advantage while simultaneously reducing risk: continuous testing, testing centers of excellence, and most importantly, a quality-driven culture with QA practices infused throughout development and production lifecycles.

To learn about how we can help you ensure quality and maximize the value of your core transformation, visit our Quality Assurance and Testing services.