For consumers, the Internet of Things has already taken a central place in their everyday lives, with the number of connected devices growing every day. However, it is only in recent years that the true potential of this technology is being explored within the insurance sector. As the environment of connected devices expands, so do the opportunities for insurers, including — but not limited to — the development of more personalized products, improved cost management, and enhanced risk prediction and prevention.

As companies continue to look for new ways to remain competitive in today’s ultra-saturated insurance market, the Internet of Things offers real-time data and analysis that can prove to be critical to long-term success.

Understanding IoT Technology

At its most basic, the Internet of Things (IoT) describes the network of physical objects — smartphones, medical sensors, and security systems, just to name a few — that are embedded with sensors, software, and other technologies. These devices constantly exchange data with other technologies over the internet, communicating and sharing information in real-time.

With the vast amount of data now readily available through IoT-enabled devices, companies across every industry have the potential to redefine their business models and drive new value. The same holds true for the insurance industry; by tapping into IoT, insurers can access continuous and real-time data, rather than simply depend on historical data, data reported by policyholders, or any other external sources. By leveraging information from IoT devices, insurers can uncover more value than ever before, creating an enhanced experience for customers and a stronger bottom line for the company.

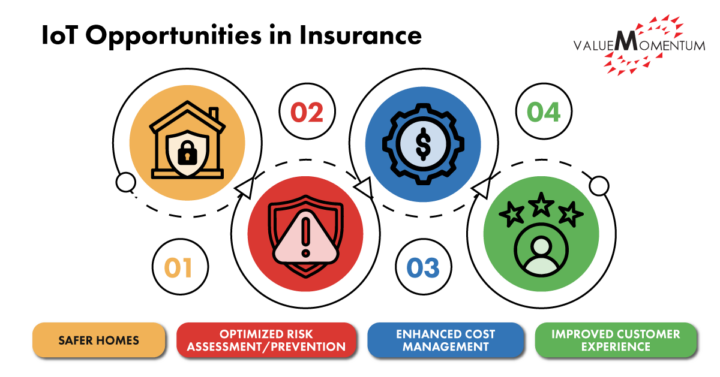

Specific Opportunities Within the Insurance Sector

Insurance is one of the fastest-growing sectors in the global IoT market. As of 2021, 20% of insurance companies were reportedly piloting, testing, or deploying IoT initiatives, according to research from ReportLinker — a trend that’s only expected to continue. As leading companies press forward with investments in IoT technologies and applications, several impactful use cases are already beginning to emerge:

Safer Homes

By offering IoT devices that monitor a connected home’s security and safety, insurers can track even the smallest anomalies in a home. If any abnormality occurs, the IoT system will automatically alert the insurance company, allowing the insurer to step in to prevent damage from happening. For that reason, IoT can ultimately provide a safer home for customers and less risk for the insurance company.

Even before the rise of IoT, insurers have traditionally offered discounted premiums to homes that have security systems. In the era of digital ecosystems, insurers can do much more by creating partnerships with third-party IoT device vendors to expand their IoT offerings, as well as working with policyholders to proactively ensure the safety of the property or people being covered. IoT not only reduces the risk of a small problem snowballing into an expensive issue, but also allows policyholders to feel more secure and cared for.

Optimized Risk Assessment and Prevention

By leveraging IoT data, insurers can take on a preventative, rather than reactive, approach. Instead of responding to issues or events after the fact, teams can now predict the occurrence of events. For example, in the event of a boiler malfunction in a commercial building, the insurer could warn the policyholder before any costly damage happens. As a result, customers feel protected, improving loyalty, retention, and trust in the brand.

With the innovative new capabilities offered through IoT, insurance companies can now elevate their value proposition from one of risk coverage to risk prevention, the latter of which provides customers a better value and overall experience. For instance, encouraging customers to use devices such as functional fire alarms, water leakage alarm devices, and heat and gas sensors in their homes or commercial buildings and businesses can help prevent property damage and unnecessary expenses. Similar to security devices, these sensors can alert both the insurance company and the customers of any irregularities. Although it is not the job of insurance companies to perform risk management, employing IoT for this purpose can create synergy between customers and the insurance company.

Enhanced Cost Management

By analyzing IoT data to optimize risk prediction, insurers can lower the number of claims and reduce costs to the organization. This benefit is further magnified by the rapidly declining prices of IoT devices — a trend that will make IoT increasingly cost-effective for both insurance companies and their customers.

Like other new technologies such as AI or machine learning, IoT opens up doors for better business outcomes. Insurers will be able to explore new business channels and generate revenue by leveraging IoT to introduce usage-based pricing models, monetize data insights, and improve customer interactions for the cross-selling of products and services.

Improved Customer Experience

Insurers can also use IoT data to identify gaps in their offerings as well as offer customized products and personalized coverage solutions to different segments of customers based on their specific coverage needs. Additionally, because of the availability of data from external sources, insurers can now access data to streamline processes (such as sales and claims) to provide an improved user experience for their customers. For example, insurance companies can improve the customer experience by pulling data from IoT devices and auto-filling certain form fields, thus sparing their customers unnecessary busywork and saving them time.

As insurers continue to make investments in IoT-enabled processes, the applications of the technology and its potential benefit to both companies and customers will only continue to grow.

Challenges of Adopting IoT in the Insurance Industry

Like any new technology implementation, employing IoT has its challenges. To successfully capture the full value of IoT, insurance companies must overcome various hurdles, including:

Data Security

Data fraud and security are two of the most pressing concerns when it comes to adopting IoT. The data that flows between the connected home, connected car, and the IoT devices employed by the insurance company is vulnerable to phishing attacks. With this in mind, many customers are reluctant to allow insurance companies to continuously access personal information and data through IoT networks, especially if the proposed benefits from adopting IoT are not consumer-focused.

In an effort to take a forward-looking stance in the face of rising cybersecurity attacks, insurers will need to follow best practices as they relate to security, encryption, and visibility.

Data Management

Managing the massive influx of data coming from connected devices and sensors can prove to be a herculean task for insurance companies. This struggle is only further exacerbated by the time-sensitive nature of certain business decisions, which may rely on the continuous access and analysis of data. Despite this pressure, a high level of care is needed to comply with data privacy regulations, especially when it comes to sensitive or protected data. As insurers work to manage this data in a quick and effective manner, it will prove worthwhile to consider the application of additional technologies and platforms such as the cloud.

Resistance to Change

Historically, the insurance industry doesn’t have a reputation for adapting quickly to changes. With this in mind, it will take time for companies across the market to accept IoT and the changes it will bring to the traditional insurance business model. Both internal and external stakeholders are often hesitant to adopt new technologies. If insurers hope to leverage IoT effectively and adapt to the new changes of the digital era, however, this resistance must be addressed. Organizations will need to communicate the full scope of benefits related to the application of IoT-enabled technologies and how they will help the company make progress toward its long-term strategic goals.

By working to address these challenges head-on, insurers can take a proactive stance and more quickly realize their investments in IoT.

How Your Insurance Company Can Realize Its Full Investment

Although there are multiple obstacles to adopting IoT in the insurance industry, many of these challenges can be overcome with a single critical solution: data accountability.

First and foremost, insurers need to ensure the security of customer data across connected devices to prevent potential data breaches. Thus, insurance companies looking to implement IoT should invest in establishing an enterprise data management strategy that encompasses necessary tools, technologies, and frameworks for securing and managing IoT data as a core asset. This ensures that appropriate fail-safes are in place should an actual breach occur and that customer data stays safe.

Furthermore, conducting awareness programs and training for all stakeholders on topics such as “why and how to leverage IoT efficiently” or “how to avoid breaches and respond to threats” can help bring the cultural shift necessary for delivering enhanced insurance experiences. If used correctly, responsibly, and with appropriate measures, IoT offers endless opportunities for insurance companies to become leaders of the digital future.

Looking Ahead to the Future of IoT in Insurance

As insurers continue to look for innovative ways to provide additional value to customers while simultaneously managing risk and cost, IoT solutions and connected insurance technologies offer a competitive edge. However, it is important to keep in mind that the key to uncovering this added value begins with a well-established enterprise data management strategy. Otherwise, risks related to cultural inertia, security, and data management will prove difficult — if not impossible — to overcome.

Ready to harness the potential of IoT for your insurance business? Find out how ValueMomentum’s Data & Analytics Services can help you develop and implement efficient data management practices.