Last week, the IDMA 2022 Annual Conference—a leading insurance data management event—drew a focused crowd of insurance data professionals to Orlando, Florida. IDMA 2022 hosted a robust selection of data management, innovative technology, and digital transformation sessions to address the growing demand for practical and proven strategies for driving business value with data in an increasingly digital world. ValueMomentum was privileged to be a Platinum Sponsor at the event, hosting a breakout session, participating in a keynote panel, as well as sponsoring an exclusive networking lunch.

Data Analytics is the Engine of Data Insights

These days, insurers are tasked with collecting, organizing, interpreting, and acting on data at every touchpoint of the insurance lifecycle. While this wealth of data affords insurers unprecedented insight into their customers, business risks, product performance, loss distribution, claims scoring, fraud likelihood, and more, it carries the burden of additional work as well—much of which is still performed manually.

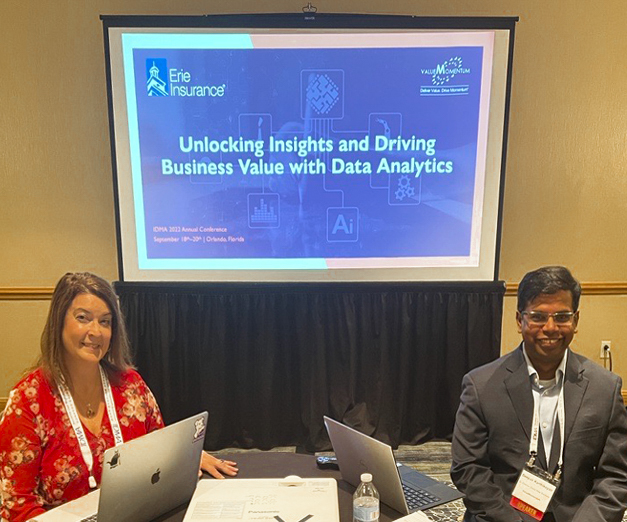

In ValueMomentum’s breakout session, “Unlocking Insights and Driving Business Value with Data Analytics,” attendees learned how to harness the power of data analytics and data science to sift through mountains of data to discover actionable insights that drive business value.

In ValueMomentum’s breakout session, “Unlocking Insights and Driving Business Value with Data Analytics,” attendees learned how to harness the power of data analytics and data science to sift through mountains of data to discover actionable insights that drive business value.

Deepak Karthikeyan, Senior Director of Data Solutions & Architecture at ValueMomentum was joined by Mary Jo Zimmer, Data & Analytics Manager at Erie Insurance to present the session. Karthikeyan and Zimmer discussed the importance of building a data-driven organization, realizing business value through analytics, and operationalizing analytics at scale. While Karthikeyan shared approaches that insurers can take to achieve business success with data and analytics—based on the work ValueMomentum is doing with our insurer clients— Zimmer shared her own experience of driving business outcomes with data at Erie Insurance. Aside from establishing the technology and architectural foundation to leverage data, a critical component of data success is talent. Zimmer emphasized how building data skills in her teams and creating a culture that embraces analytics made data initiatives successful at Erie.

Accelerate, Automate, & Innovate Your Data Management

As the insurance industry continues to evolve, a big challenge for insurers regarding the use of data continues to be legacy systems. This is especially true in the realm of data management, which is still largely a manual effort performed on antiquated software. Since data management is such a mission-critical part of insurance success, it’s the natural place to start modernizing.

ValueMomentum’s Executive Vice President and Head of Data Practice contributed to the discussion on data management in the keynote session, “Looking Ahead: Transforming Your Data Management Practices.” This keynote panel was moderated by Verisk and included leaders from Informatica, R Systems, and IDMA itself to discuss the growing chasm between the data management practices insurers need to implement and the ones they actually do.

Leveraging their extensive collective experience, the panelists relayed accounts of slow data collection, poor data hygiene, and disconnects between siloed teams—and even carriers and customers themselves. The solution to these problems, they discovered, was to focus on three pillars of modern data management: acceleration, automation, and innovation.

Through automating repetitive, low-value interactions, carriers can save considerable time on regular tasks, like processing claims. And by investing in new emerging technologies—such as leveraging AI to calculate probabilities of policyholder litigation—they can claim early adopter advantages over their competitors and claim new market share.

Data Is the North Star for Insurers

While the insurance industry has become increasingly dynamic in recent years—between new regulations, digital transformations, talent wars, evolving customer demands, and more—there are a still few cornerstones that you can rely on, and data is one of them. In fact, data has become more important than ever to insurers, and investing in data analytics and data management will deliver lasting dividends to insurers of all sizes.

The IDMA Annual Conference proved to be a very productive and valuable event for our team. We had the pleasure of re-connecting with old and current clients, fostering relationships with new ones, and sharing our experiences with the broader insurance data community. The insurance data space is particularly exciting now, and we are invigorated to help our insurer clients drive business outcomes and value through data and analytics!

The IDMA Annual Conference proved to be a very productive and valuable event for our team. We had the pleasure of re-connecting with old and current clients, fostering relationships with new ones, and sharing our experiences with the broader insurance data community. The insurance data space is particularly exciting now, and we are invigorated to help our insurer clients drive business outcomes and value through data and analytics!

Want to build the foundation to drive success to your data transformation? Learn more about how we can help you with your data and analytics initiatives.