With large insurers and application providers leading the way, cloud migration strategy is a top concern for property and casualty insurers. For most, it’s not a question of whether they will migrate. It’s a matter of how and how soon they get there.

If you’re wondering whether rearchitecting your enterprise software applications is more beneficial than replatforming them, you may be asking the wrong question. Property and casualty insurers have a number of choices when it comes to cloud migration strategies, each with its own benefits and drawbacks. But these strategies should not be thought of as either-or propositions. In fact, they are probably best thought of as sitting on a continuum.

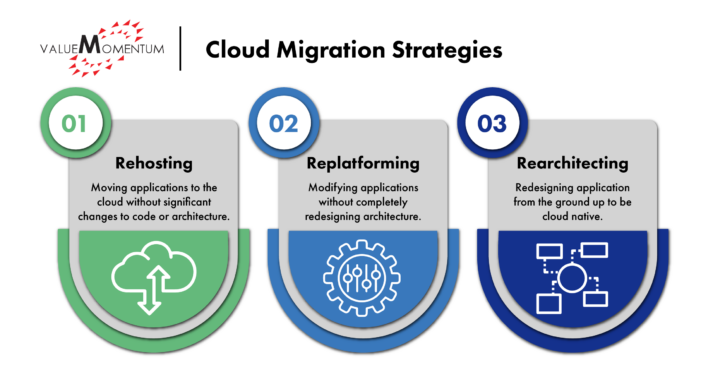

Understanding these strategies is crucial for making informed decisions and selecting the approach that best aligns with your individual goals and requirements. Because some vendors and services providers may have their own variations, let’s start by loosely defining some concepts.

Types of Cloud Migration Strategy

Rehosting involves moving applications to the cloud without significantly changing their code or architecture. It’s a straightforward approach and a first step that allows insurers to migrate their applications to the cloud quickly. The main benefit of rehosting is migration speed, as it requires minimal modifications to the existing applications.

However, rehosting has its limitations. By simply moving applications as-is, insurers won’t be able to fully capitalize on the advanced features and services offered by cloud platforms. Rehosted applications are not optimized for cloud performance, nor are they capable of scaling as efficiently as cloud-native applications.

Replatforming involves modifying the applications to better leverage cloud services without completely redesigning the application architecture. This approach seeks a middle ground between the simplicity of rehosting and the complexity of rearchitecting.

With replatforming, insurers can optimize specific components of their applications to take advantage of cloud-native services. For example, they may containerize an application to improve portability and scalability or adopt managed database services to reduce maintenance and overhead costs. Replatforming improves performance, increases scalability, and can lead to reduced operational costs compared to rehosting.

Rearchitecting is the “big bang” approach. It involves redesigning applications from the ground up to be cloud native. This approach takes full advantage of the cloud’s capabilities by leveraging microservices architecture, serverless computing, auto-scaling, and other cloud-native features.

The benefits of rearchitecting are significant. Cloud-native applications are highly scalable and resilient, and they can be easily updated and maintained. They can also leverage the full range of cloud services, enabling insurers to innovate faster and deliver better customer experiences. As a result, many IT professionals are eager to achieve this state, and some assume that they can save time and effort by going directly to rearchitecting.

However, rearchitecting is the most complex and time-consuming migration strategy. It requires a significant investment in skills, resources, and time. Rearchitecting may also involve changes to the application’s functionality and user experience, which can impact end-users and require additional training and support.

The Case for Replatforming as an Intermediate Step

When comparing the benefits and drawbacks of cloud migration strategies, insurers need to consider factors such as the complexity of their applications, the desired level of cloud optimization, the availability of skills and resources, as well as time and budget constraints.

Successful migrations follow a strategic approach based on incremental improvement, and that involves leveraging replatforming as an intermediate step between rehosting and rearchitecting.

Balancing risk and reward, the replatforming approach allows insurers to realize many of the cloud’s benefits without taking on the complexity associated with rearchitecting. By making targeted modifications to their applications, insurers can improve performance, scalability, and cost-efficiency while minimizing disruption to their business operations.

Perhaps more importantly, replatforming can also serve as a foundation for future rearchitecting efforts. By adopting cloud-native services and modernizing parts of their applications in phases, insurers can gain valuable experience and knowledge about cloud technologies. This experience can inform future decisions about which applications to rearchitect and how to approach the process.

Why Replatforming Before Rearchitecting Makes Sense

For insurers, many applications are so critical to the business that any disruption or downtime is unacceptable. By replatforming these mission-critical applications first, insurers can stabilize and then modernize them incrementally without introducing undue risk.

Another challenge of any cloud migration is justifying the investment to stakeholders. With a replatforming stage, insurers can demonstrate the value and ROI of cloud migration on a smaller scale, building support for larger rearchitecting efforts.

Replatforming also acts as a valuable assessment phase, helping insurers identify which applications are the best candidates for rearchitecting based on business needs and potential impact. This data-driven approach allows insurers to prioritize their rearchitecting efforts based on factors such as business criticality, performance requirements, and potential for innovation.

Why Rearchitecting Is Still a Goal

While replatforming offers substantial business and IT benefits, don’t confuse “cloud optimized” for fully rearchitected and “cloud native.”

Cloud-native architectures are even more flexible, modular, and adaptable to changing business needs in addition to IT needs. As new cloud services and technologies emerge, developers can create new products and features more quickly on a rearchitected cloud-native application. They also can more easily integrate new partners and ecosystems in addition to leveraging more data sources, insurtechs, and whatever comes next. This allows insurers to stay agile, respond quickly to market shifts, and seize new opportunities for growth and differentiation.

By taking advantage of the cloud’s capabilities, fully rearchitected, cloud-native applications can utilize a growing number of new and emerging cloud-native services, including artificial intelligence, machine learning, real-time data processing, and advanced analytics.

These new and emerging capabilities will undoubtedly help insurers further personalize interactions; streamline underwriting, claims, and other processes; and improve agent, broker, customer, and partner satisfaction and loyalty, all of which support growth and profitability.

A cloud transformation is not a quick and easy project to be completed in one go. Replatforming before rearchitecting is a smart strategy for insurers looking to modernize their applications in the cloud.

By building cloud skills, proving value to stakeholders, identifying the best targets for rearchitecting, managing risk through phased migrations, and avoiding disruption to mission-critical applications, insurers can set themselves up for success in their cloud transformation journey.

Want to learn more about assessing your preparedness for cloud migration? Download “Cloud Transformation in Insurance.”