In today’s competitive insurance landscape, time-to-market and efficient product cycles are crucial differentiators for business growth. Given these factors, more insurers are modernizing their core systems to achieve greater capabilities. Based on a recent Aite-Novarica research, over 50% of insurers have plans to expand Quality Assurance (QA), Cloud, and Agile practices to support their modernization efforts.

As insurers expand their application portfolios to capture evolving market opportunities and meet customer demands at speed, they face a new challenge: how do they minimize risk and ensure that these complex applications perform as expected? Application testing — as a key component of a QA testing and software testing strategy— enables insurers to further maximize their testing efforts for long-term success.

What is Application Testing?

Application testing tests a specific enterprise application or solution—such as an insurance core system—across the development lifecycle. It optimizes and validates critical business activities, including policy rating, underwriting, and claims. It also ensures that IT processes are thoroughly vetted, which involves validating both the interactions of various components as well as the application end-to-end. End-to-end application testing and validation are essential for today’s microservices-based architectures.

Quality Assurance practices have traditionally been organized around testing types, like user acceptance testing (UAT and generic validation tools), with a focus either on quality or speed, but not both. Now, insurers are expected to deliver quality at speed, with validation processes customized at every stage of the product cycle to the solution being adopted as part of a Quality Engineering strategy. This requires test automation for speed and conducting validations continuously throughout an application’s lifecycle for high quality.

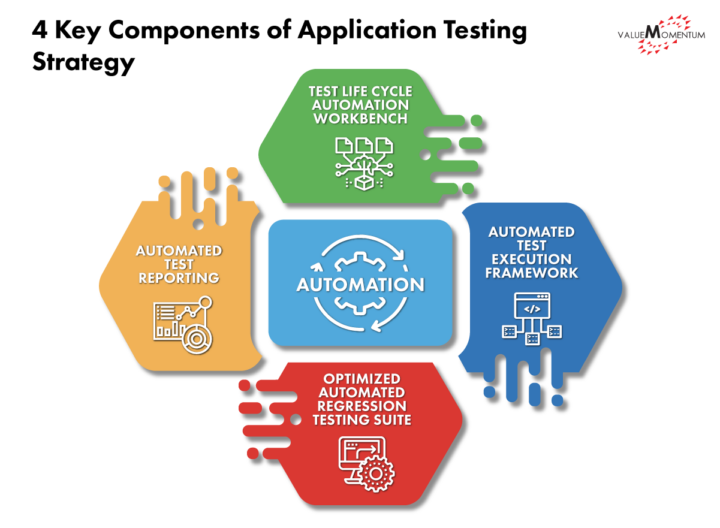

4 Key Components of a Robust Application Testing Strategy

The most sophisticated application testing solutions provide QA/QE teams with innovative tools that focus on automation. Such solutions incorporate four key components:

- Test Life Cycle Automation Workbench. This enables a QA/QE team to define specifications and scenarios that model planned real-world behaviors, such as the workflows within the policy administration system. Using these models, the team generates test scripts and develops a scripts repository. A testing workbench automates all testing across development and production, rather than automating a single test process. This includes the tools and algorithms required to generate and optimize various combinations of actions.

- Automated Test Execution Framework. This is critical for the modern QE practice of continuous integration/continuous development (CI/CD). Automating test execution effectively requires a comprehensive Agile framework to launch tests based on user-defined and application-specific criteria, such as billing or claims, along with an advanced test execution repository.

- Automated Test Reporting. This ensures speedy defect identification and resolution while feeding the results back into an application’s lifecycle. Advanced test reporting capabilities provide an efficient feedback system for model-based testing and integrate seamlessly with application lifecycle management and DevOps tools.

- Optimized Automated Regression Testing Suite. Although there are multiple automated regression testing suites, an application-specific solution aligns tightly with a specific core system. This ensures automated regression testing is both rapid and granular enough for high-quality results.

3 Key Investments for Insurance Application Testing Success

In order to gain the full advantages of application testing as part of a sound QA/QE strategy, insurers must make three fundamental investments. These three elements are the cornerstone for the success of insurance application testing.

- Shift-Left (or Look Left) Testing. Shifting left means to start the testing phase early in the product cycle. As both a technical and cultural investment, a Shift-Left approach infuses testing throughout an application’s entire lifecycle: from project inception, through development, during delivery, and continuously while in production. This involves testing both across the insurance domain—claim life cycle, underwriting, policy administration—and the technologies themselves, including APIs, Cloud, and User Experience. Shift-Left approach aligns with Agile Methodology and DevOps, further maximizing the ability to track defects and customize solutions as needed.

- Smart Testing Suites. Yesterday’s testing tools are not enough to achieve the testing speed and quality outcomes customers demand today. Insurers need to invest in Smart Testing Suites and related accelerators, or partner with a service provider that can apply the appropriate tools on an as-needed basis. These tools augment test automation, which streamlines testing cycles and removes unnecessary manual labor. Test Automation does more than simply improve an internal product cycle; it can test a customer’s entire journey—from accurate underwriting to access to policy and websites to claims handling—to drive ROI and customer satisfaction.

- Appropriate Expertise. Like smart testing suites, successfully modernizing an insurer’s QA/QE strategy requires updating human capital. Successful automation doesn’t mean an autopilot. Insurance firms need trained and experienced people who can use the latest tools and maximize their technology investments for application testing. Insurers can either develop their in-house talent or strategically partner with technology providers to obtain the necessary depth and breadth of expertise. Many also pursue a hybrid approach, where a partner completes tasks and transfers knowledge to insurers’ internal resources.

Regardless of how insurers ultimately approach QA and their insurance application testing as part of a QE strategy, the goal is to find and remediate defects in the shortest possible time—frequently in fractions of a second and early in the development cycle.

Insurers embracing application testing are reducing enterprise risk and significantly increasing their ability to address market conditions while simultaneously boosting user and customer satisfaction. In combination, these benefits enable industry leaders to capture additional market share and ultimately, achieve long-term success.

Learn more about our expertise in Insurance application testing by visiting our QualityLeap practice.