In an era marked by rapid technological advancements, cloud is becoming an invaluable tool to drive business growth. Insurers are gearing up for a monumental shift as they steer away from on-premises core suites and toward cloud-based core systems.

The statistics are telling. Organizational projections indicate a significant increase in cloud adoption, with the anticipated annual growth in cloud services hovering around 32% by 2025 according to McKinsey research. The allure of cloud-based core systems lies in their potential to revolutionize insurers’ operations, providing seamless omnichannel experiences, a diverse array of integrated ecosystem services, and rapid solution rollouts.

However, while the adoption of cloud-based core systems is on the rise, maintaining and optimizing these systems poses a unique set of challenges. This blog explores these challenges that insurers face in maintaining cloud-based core systems and showcases a case study of one insurer’s journey to upgrade their core systems.

Fighting the Uphill Battle of Maintenance with Application Management Services

Cloud-based core solutions are never one-size-fits-all and require balancing the exact capabilities insurers need across both short-term and long-term goals. Due to this, the initial allure of cloud-based core is often tempered by the reality of continuous upgrade and maintenance obligations.

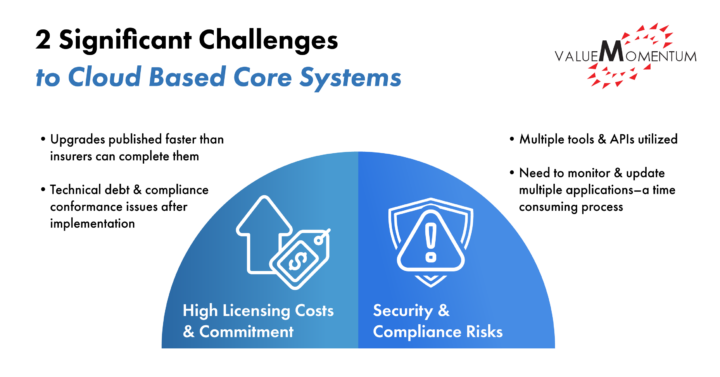

Two of the most significant challenges insurers encounter are:

- High Licensing Costs and Commitment: Transitioning to a cloud-based core system involves hefty initial and sustained investments in the balancing of core suites. Most insurers cannot transition 100% to the cloud in a short period of time and utilize a mixture of on-premises and cloud-based core services in the interim. While such a hybrid state is necessary for existing core business systems to function, this approach poses a challenge when it comes to performing timely maintenance and upgrades. Core system providers often publish new upgrades faster than insurers can complete them, incurring further technical debt and compliance conformance issues even after implementation.

- Security and Compliance Risks: Though SaaS/cloud solutions offer unparalleled ease of adoption and scalability, they also introduce new security risks. Even within a singular core suite, insurers often utilize multiple tools and APIs (application programming interfaces) to connect data across internal business users, third parties, and agents. Security teams need to monitor and regularly update multiple applications, a time-consuming process that can always be overridden by a new upgrade from the core systems providers. The dynamic nature of the cloud requires insurers to possess a comprehensive understanding of security best practices, as switching vendors is not always a straightforward process.

Successful core modernization hinges on insurers’ ability to identify a compatible and secure cloud solution while cultivating a symbiotic relationship between business and IT. This often means embracing a multi-cloud strategy and prioritizing business goals over cloud’s technical functions and value.

Indeed, the metrics of business goals — such as scalability, customer experience, ecosystem connectivity — will matter more than the success of a particular technical function of a core system. As more insurers implement cloud-based core systems, they must pay attention to the maintenance of such systems and how they will continue to evolve and further drive their business goals. Application management services are increasingly becoming the de facto solution to these maintenance challenges.

One Insurer’s Journey: Upgrading to Guidewire Cloud

Business Challenge: A Fortune 500 insurer partnered with ValueMomentum and Guidewire to migrate their Guidewire Claim Center to the Guidewire Cloud, adopting a SaaS (software-as-a-service) approach. The insurer faced a maintenance challenge, struggling to keep up with their Guidewire system upgrades. Previously, updates were released annually, but with Guidewire’s move to cloud, updates introducing new features occurred every six months. Despite transitioning to the cloud to expedite upgrades and access advanced functionalities for improved customer service, the insurer experienced further delays and complexities from the ongoing pressure to upgrade on time.

Solution: The insurer needed to align its code standards with the latest product guide to make them compatible with the cloud. Because integration applications were also outdated, security concerns arose due to the public network location of Guidewire Cloud. The insurer needed enhancements in authentication and security measures as part of their upgrade.

To tackle this challenge, a gap analysis was performed with newly validated standards and rewritten codes. The insurer identified critical differences between their on-premises and cloud systems, and a centralized pipeline was established to securely migrate data to the cloud, particularly the transfer of archived claims data to the AWS S3 bucket.

Value: With the help of ValueMomentum, the insurer was able to access Guidewire upgrades within months rather than a full year, facilitating faster partner integration and reducing integration time from 6-to-7 months to 2-to-3 months. The cloud-based core allowed the insurer to maintain a balance between on-premises and cloud-native applications following Guidewire upgrades. Moreover, product deployment followed a continuous cycle in the cloud, promoting seamless updates without major disruptions.

Embracing Long-term Success with Application Management Services

Navigating the complex landscape of cloud-based core insurance systems demands a comprehensive strategy that goes beyond initial implementation. The challenges of maintaining, upgrading, and optimizing these systems underscore the need for a reliable partner that provides ongoing support and strategy to overcome the hurdles of cloud maintenance.

In a landscape where insurers are transitioning to cloud core insurance suites at an unprecedented pace, the need to ensure successful cloud-based core system maintenance cannot be understated. It allows insurers to focus on driving business outcomes, delivering exceptional experiences, and embracing innovation without being bogged down by the complexities of cloud maintenance. ValueMomentum’s suite of application management service offerings provide insurers with the tools, strategies, and long-term partnership needed to fully harness the potential of cloud-based core systems, setting the stage for a transformative future in the insurance industry.