In today’s fast-paced digital environment, IT teams face pressure to deliver innovation and improvements rapidly. Yet many still rely on traditional project-based approaches that can impede agility. The ValueMomentum team recently spoke with the CIO of a midsize, Midwest-based property/casualty insurer who successfully led their IT organization through the journey from project- to product-centric delivery. Product-centric transformation in insurance has gained prominence over the last few years, and it’s not hard to see why.

A survey conducted by McKinsey found that making the shift not only enables organizations to better align their technology capabilities with their business strategy, but it can also reduce time to market and cut down on product defects by 50-70%.

As all insurance IT leaders know, an operating model shift doesn’t happen overnight. In fact, it may take years to gain the executive and business buy-in needed to make the switch and then implement an entirely new IT delivery model. When done correctly, however, making the leap from a project-centric model to a product-centric model can help your team yield major benefits.

Why Invest in Product-Centric Transformation?

With project-centric delivery, work is organized around implementing specific technical solutions. Teams form around deliverables like “launch a mobile app” or “migrate servers to the cloud.” In contrast, product-centric delivery revolves around ongoing ownership of a business capability. Teams are stable, long-term groups align to products like “personal lines policy admin” or “agent portal.”

With the product-centric approach, priorities shift according to business needs, but the team maintains long-term ownership over the product. Funding is tied to sustaining the team rather than being tied to funding temporary projects.

For the insurance carrier we spoke with, shifting to a product-centric operating model has streamlined IT delivery and operations. The organization has seen benefits across the following areas:

- Business-IT alignment: With dedicated teams per product, priorities stay synced to business outcomes.

- Flexibility: Work can shift rapidly as business needs change without upending projects.

- Clear ownership: Consistent, accountable teams build up product mastery versus having fragmented knowledge of various product components.

- Time to value: Established teams and priorities avoid delays that can come from forming various short-term project teams.

- Employee engagement: Ongoing ownership cultivates expert teams invested in “their” product’s success.

- Vendor integration: Partners like ValueMomentum can be embedded within product teams for seamless collaboration.

The product-centric delivery model advances IT’s business contribution by organizing technology delivery around core capabilities instead of around one-off initiatives. This model enables a better user experience for both business users and customers alike.

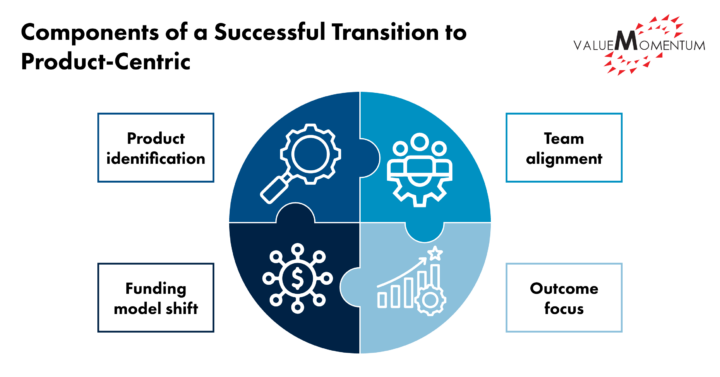

Components of a Successful Transition to Product-Centric

Evolving to a product-centric delivery model requires rethinking the entire operating model. In the case of the insurer ValueMomentum spoke with, this meant looking at:

- Product identification: The first step was mapping products to the carrier’s business capabilities at the right level, without getting caught up in details that were too granular.

- Team alignment: Resources were realigned into ongoing product teams versus project teams.

- Funding model shift: The budgeting structure moved from funding projects to funding product teams to provide pre-defined capacity.

- Outcome focus: Metrics for success shifted from outputs like “app built” to outcomes like “reduced customer service calls.”

The transformation has brought order to demand and delivery while positioning IT as a business enabler. Product-centric models can help IT teams break through legacy mindsets about what it provides the organization as a whole and help break down silos.

As insurers undertake IT transformations, expert IT services partners can be a crucial part of the journey, providing specialized capabilities and offering additional resource bandwidth. Partners like ValueMomentum have deep insurance expertise and Agile delivery mastery, and they can embed their own resources within insurers’ product teams to share knowledge.

By complementing insurers’ IT staff with additional skills and capacity, ValueMomentum helps insurers adopt new operating models smoothly, optimizing IT delivery to drive innovation and business results. It’s clear that making the switch to a product-centric focus can help revolutionize an insurer’s IT organization, taking it from order taker and turning it into a strategic business asset. Partnering with ValueMomentum can help insurer IT teams make that shift with as little friction as possible.

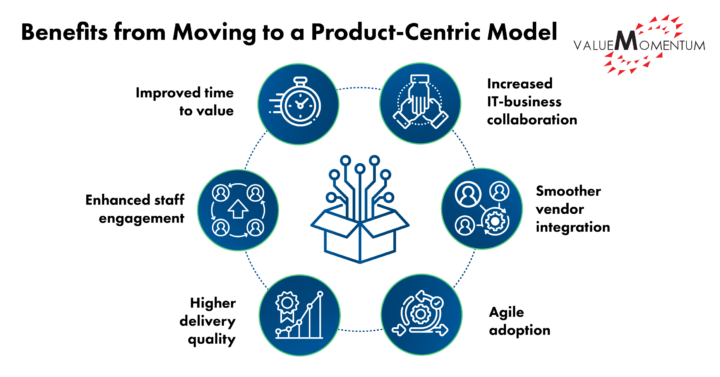

Benefits from Moving to a Product-Centric Model

The results seen by the insurer we interviewed showcase the advantages of product-centric IT delivery. Since implementing the new model, this insurer has seen:

- Improved time to value: Faster deployment of business priorities

- Increased IT-business collaboration: Tighter alignment to business outcomes

- Enhanced staff engagement: Employees invested in products’ success

- Smoother vendor integration: Embedded partnerships within teams

- Higher delivery quality: Products strengthened by ongoing ownership

- Agile adaptation: Ability to pivot priorities without delay

The product-centric approach wasn’t the norm when the CIO we spoke with joined their current organization five years. Instead, the IT team operated in a “hodgepodge model” with no consistent delivery framework. Moving to a product-centric focus required change management and a phased rollout.

Once product teams were formed, the CIO ensured that business leaders were linked to each to maintain alignment. They also moved to funding the teams instead of funding projects, allowing capacity to shift between priorities as needed.

The result is an IT organization that is structured for stability yet nimble enough to keep pace with emerging needs. It’s a model tailored for the age of rapid disruption.

Partnering for Product-Centric Transformation

As insurers modernize IT delivery, ValueMomentum can provide the expertise needed to navigate their journey. With more than 20 years of insurance technology experience, ValueMomentum understands the needs of insurers — from the perspective of both IT and the business.

Specific capabilities ValueMomentum offers insurers undertaking this type of organizational transformation include:

- Operating model design: Assistance mapping business capabilities to streamlined IT products

- Change management: Proven methods for gaining buy-in and transitioning staff smoothly

- Agile coaching: Helping insurers adopt Agile development methods within teams

- Delivery acceleration: On-demand skills to speed time to value for critical initiatives

- Vendor integration: Seamless partnerships within newly formed product teams

With ValueMomentum, insurers can evolve IT capabilities confidently while minimizing disruption. This transformation positions IT as an engine fueling innovation and resilience. The future favors insurers who can deliver technology at the pace of today’s market.

To learn more about how ValueMomentum can help your team optimize its IT capabilities, check out our digital and cloud solutions.