It has never been easy to establish a growth strategy in the ever-changing world of insurance. But in 2023, it may be even more challenging than usual. The insurance industry is in a state of profound transformation, driven by converging factors that have introduced a new era of uncertainty. Property and casualty carriers face a combination of complex macroeconomic and industry trends and face new risks that require insurers to adapt and evolve risk assessment techniques, policy wordings, services, and capabilities.

Meanwhile, new technologies, such as generative AI, are increasing the pace of change.

Bringing new opportunities for value creation to life is no easy feat. It requires orchestrating operations, technology, services, and business solutions. As President of ValueMomentum, I have a front row seat, along with our broader team, to partner with our large and varied insurance customer base to understand and help address many of the issues property and casualty insurance leaders are tackling each day.

Factors Causing Uncertainty in Insurance

The nature of risks is evolving faster than ever, especially risks related to natural catastrophes, net-zero transitions, supply chain disruptions, and cyber risks. Additional emerging trends such as the rise of autonomous vehicles and home automation further contribute to the myriad challenges carriers have to consider. However, these also represent a significant opportunity to step forward to address the growing protection gaps.

In addition, customer expectations have been evolving rapidly. Customers today demand personalized, seamless experiences from every organization they interact with, and insurers are no exception. The expectation is now for an insurance experience that adapts to customers’ needs.

To address these trends, carriers must continue to transform their capabilities and talent as underwriting and claims shift from an art to a science.

Powering Growth with a Digital Core

So, how are insurers tackling these challenges to achieve their growth goals? Many carriers ValueMomentum works with are reimagining their business as value streams that reflect the customer journey. They’re working to dismantle their legacy systems and outdated processes to enable better agility and find more opportunities to innovate.

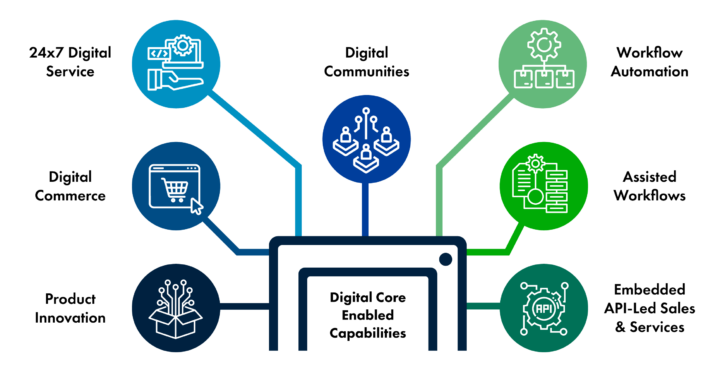

Tailored coverage options, AI-fueled semi-automated risk and loss assessments, expanded distribution channels, and tools that enable near-real-time service are ways insurers are improving their offerings across the entire insurance value chain. At the heart of these enhanced capabilities is a digital core, which serves as the foundation for a modern insurer’s business strategy. A digital core enables the following capabilities:

- Product innovation. Involves the simplification and rationalization of existing product lines plus creating niche coverage lines tailored to refined microsegments.

- Digital commerce. Agents, customers, and insurance employees are able to seamlessly research, consider, and purchase products and services.

- 24×7 digital service. Customers access services at the time of their choosing and from the device of their choice.

- Digital communities. Customers can interact with insurers digitally for everything from customer support to peer-to-peer information sharing.

- Workflow automation. Insurers remove friction and meet customer expectations for real-time interactions.

- Assisted workflows. Intelligent workflows powered by data, analytics, and automated processes help employees focus on serving customers.

- Embedded API-led sales and services. Insurers can deliver value to customers on a multitude of platforms by embedding their own or partners’ application programming interfaces (APIs).

All of the capabilities enabled by a solid digital core, paired with cloud and data functionality, are foundational to delivering operational efficiencies, meeting customer expectations, and achieving business growth goals. To bring all these factors together, insurers must have an ecosystem that allows for the orchestration, delivery, and management of the solutions powering each of these digital capabilities. Whether the solutions are a service, a tool, or a platform, they need to be aligned to each insurer’s specific needs and strategies.

Questions Insurance Leaders Need to Ask Themselves

Given the technological disruption, changing customer expectations, and regulatory shifts that carriers are facing, insurance leaders are having to answer new questions as they chart their course for the future. Here are five vital questions insurance leaders need to answer when planning their growth strategies for 2024.

- How are key market changes being factored into your organization’s upcoming initiatives?

- What digital capabilities have you built into your roadmap to ensure your team can scale and pivot in response to market changes?

- How might your digital transformation journey need to change in response to market challenges?

- How are you building unique, customer-centric experiences for your clients?

- How can partnerships and industry collaborations deliver on your business goals?

The insurance industry is shifting rapidly, and carriers need to evolve their strategies to stay competitive and achieve their growth goals. A digital core is a solid foundation any insurer needs to implement new technology, meet evolving customer expectations, and keep up with changing regulations.

Interested in hearing how top insurance leaders are addressing the questions above and more? Sign up for the upcoming panel discussion I’ll be leading at ITC, where Tokio Marine HCC — Cyber and Professional Lines Group’s Deputy COO Jamie Kinsley and Country Financial’s SVP and CIO Adam Garey will offer their perspectives on how they are addressing these topics at their organizations.