In this digital age, all disruptive innovation has focused primarily on delivering to customers as soon as possible. In order to do that, insurers have outsourced capabilities from solutions providers, and focused on building better API and ecosystem environments that can accommodate external microservices. Meanwhile, with in-house development, insurers have focused on innovating on their core functions in claims, underwriting and risk management to deliver on customer demands for better experience and speed-to-market..

AI, automation and ML have revolutionized the insurance industry, helping companies serve their customers in faster and smarter ways. Insurers today continue to find innovative ways to leverage AI and ML to save on time and costs and increase operational efficiency.

The proliferation of data and data collection has changed the way we see innovation. In order to maximize any investment in AI, insurers have to be able to fully leverage their data. While before insurers have struggled to access and maintain their data for ML, there are now technologies on the market that have created high quality and accessible data environments and platforms. Insurers have also found it difficult to determine which AI technologies are worth the cost of integration. These days, however, certain new intelligent technologies have proven successful — allowing insurers to hone in on how AI will help their company operate faster. These 4 trends demonstrate how insurers today are leveraging innovation to move towards enhancing the speed and efficiency of their insurance business processes.

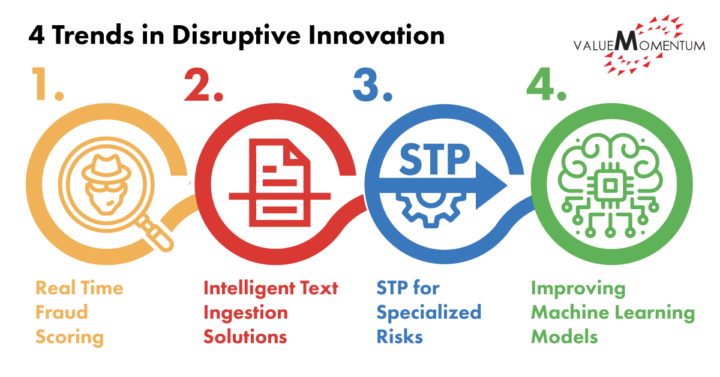

4 Trends in Disruptive Innovation

1. Real Time Fraud Scoring

Many insurers are incorporating automated real-time digital fraud detection to keep with the growing sophistication of fraud tactics. AI and ML algorithms are trained to detect patterns of fraud and can enable insurers to analyze a wide variety and volume of data sources, weighing structured, unstructured and third party data to identify potential fraud. The algorithm then provides a real-time fraud score indicating whether or not an insurer should investigate further.

For example, using AI, an insurer identifies any digital alteration to pdf documents like medical bills or other claims documents or alert the adjuster if the document has previously been submitted. Software solution providers like FRISS, will calculate scores at FNOL and then will automatically recalibrate as new elements to the claim are submitted or changed.

As STP claims processing becomes more popular for simple or low-value claims, insurers are incorporating real-time scoring to bring attention to the claim before disbursements are made. During the underwriting process, insurers can use modernized insights solutions that leverage internal and third party data to detect fraudulent entities and applicants who supply inaccurate or false information.

2. Intelligent Text Ingestion Solutions as a Must-Have

Much of the insurance business still involves paper or paper images, forcing insurers to turn to manual processing of claims submissions documents. However, many insurers are investing in intelligent text ingestion (ITI) tools and solutions for further automation and faster delivery cycles.

Solution providers have created tools that help insurers ingest unstructured text-based claims and policy applicant documents and images to capture optical characters through OCR conversion, apply AI to identify the fields of text, then extract and store the data. Algorithms can detect handwritten policy numbers, for example, apply a label and sort into internally-kept datasets and custom data categories. One provider, ACORD, has a document digitization solution called Transcriber that automatically extracts data from and populates unstructured data onto ACORD forms using custom mapping tools and AI frameworks. Through microservice APIs, insurers can integrate Transcriber across their platforms.

By implementing these insurance – specific ITI tools, insurers can save the manual effort of processing and routing while reducing errors and oversight.

3. STP for Specialized Risks

Insurers are implementing STP to expedite processing for specialized underwriting and auto-adjudicated claims payments. Although STP in underwriting personal lines has been fairly common, mostly for low-cost high transaction claims, the number of insurers using STP for commercial and specialty lines has been increasing. In claims processing, this has also led to a higher percentage of claims submitted electronically and auto-adjudicated.

Insurers now understand the “sweet spot” for STP, wherein risk is well understood, scope is limited and easy to model. Because insurers with these lines are experts on their risk profiles and appetite, they are able to build STP that are narrowly confined to specific requirements and rules. For example, Berkshire Hathaway Specialty Insurance launched Berxi to sell professional liability and medical malpractice coverage to small businesses and uses STP to quote and issue a policy in under five minutes.

More and more insurers are building and refining accurate predictive models using ai and machine learning in order to build enhanced STPs. As a result, insurers are able to divert their energy towards relationship management and more complex risk.

4. Improving Machine Learning Models

In general, many insurers are taking a step back to focus efforts on fully leveraging data and past experiences to improve the accuracy of intelligence-related investments and tools. Using techniques like reinforcement learning, supervised learning, and unsupervised learning, insurers can build better machine learning models to improve AI systems across the entire insurance value chain. This may involve improving the hygiene of data sets used in training, increasing data sources, and re-analyzing the relationships between data.

For example, Canadian-based insurer Manulife has partnered with Waterloo Artificial intelligence Institute for years working on improving and researching predictive models for disability claims and fraud detection. Alongside Ai focused experts and engineers, Manulife has worked to enhance their leveraging of data from over 16 million clients around the world. By improving the way that AI learns, insurers can gain better value and efficiency out of their AI capabilities across all operations.

Disruptive Innovation on the Horizon

Insurers that want to continue to deliver at speed need to leverage innovative technologies in order to keep up with the rest of the industry and customer demands. The future will look very different as New technologies continue to enter the industry. Especially with the emergence of ChatGPT, insurers are wondering how new groundbreaking innovation will change the game.

By incorporating advanced technologies, insurers can improve their business and remain competitive as intelligent offerings become more mainstream. Those who do not know how to start their innovation journey and adapt their core processes, products, and services will fail to hold the attention of the market.

The trick is to embrace the fact that disruptive innovation is coming, and to work with partners to help understand how to leverage new technologies to quickly develop a unique edge in an evolving landscape. By working with digital transformation experts, insurers can learn how to best enhance their business processes to serve customer’s demands.

Ready to work with experts to figure out which AI-driven capabilities can help your company deliver better products and increase speed-to market? Visit our Digital Services to find out how your company can get ahead in the race to digital.