The explosion of consumer data and its accompanying analysis have long been identified as business game-changers in insurance if not all industries. The argument is no longer why insurers need a modern data platform, or why data modernization in insurance is necessary, but how can insurers modernize—what strategies can they employ to modernize with speed while cutting costs, so they can reap the competitive advantages that data provides.

Key to driving success to any technology implementation—including data modernization—is identifying what a new platform enables and which goals to prioritize to deliver quick and valuable business results, or much-needed ROI. For P&C carriers, the business goals they seek are common: develop new products and channels, achieve customer 360, enable operational efficiency, leverage connected insurance, and apply advanced analytics for insights. At the heart of these goals reflects a new urgency among insurers to expand new distribution channels, personalize customer experiences, and further operationalize their services within ecosystem networks.

But what challenges hinder insurers to reach these goals, and what fundamental approach can help guide them to tackle these challenges? In this blog, we delve into the current state insurers face with their data initiatives and provide an approach to jumpstart one’s data modernization journey.

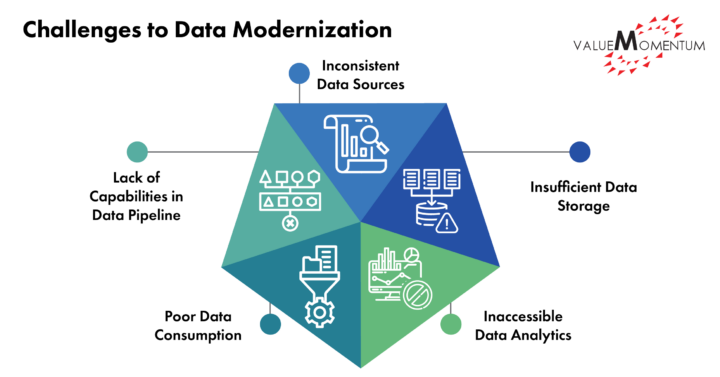

Challenges to Data Modernization in Insurance

Despite clarity of both demand and business goals, data modernization in insurance has been a slow and arduous process. A number of technical challenges plague insurers today, specifically:

Inconsistent Data Sources

With multiple systems supporting the insurance business, insurers continue to struggle with interfacing issues. Since data is collected and stored in various core systems—from modern core systems such as Guidewire and Duck Creek to legacy home-grown systems—, aggregating varied data sources to a standardized format is a big challenge. This has also translated to inconsistent taxonomy across the enterprise, as well as inconsistent references to data. Without a central master data management setup across source systems, data can remain unreadable and cannot be leveraged for insight.

Lack of Capabilities in Data Pipeline

Most insurers lack key capabilities to set up data pipelines necessary to parse core system (XML/JSON) payloads for functionalities such as policy, quote, and claims. Many also do not have a centralized data center (CDC) to allow for functionalities such as a full claims data refresh. A long-running data pipeline further hinders the process of converting data from varied sources across telematics, IoT sensors, and other data collection sources.

Insufficient Data Storage

Insurers often store duplicate business unit data sets across their respective businesses in personal, commercial lines, and claims. These data sets take up extra space and cannot be deleted without manual intervention. Security across storage has also been a challenge, principally to store and access sensitive data attributes from core systems.

Poor Data Consumption

Lack of a unified semantic layer across personal and commercial lines provides no easy way to perform timely ad-hoc analysis and data exploration. How to consume the data directly translates to how to derive action from data insights, which is critical for insurance practices such as risk projections.

Inaccessible Data Analytics

Data needs to be fully available and accessible, but without the ability to train and deploy analytical models and leverage advanced tools in AI/ML, data remains underutilized. Properly deploying analytics requires tackling the challenges above, along with a technical architecture to organize consumable data.

To address these challenges, P&C carriers are undertaking data modernization initiatives with cloud data platforms and modernized data tools that directly accommodate these structural inconsistencies and gaps. Based on our experience helping insurers embark on their cloud data platform journey, here’s a guiding approach to set up your data modernization roadmap.

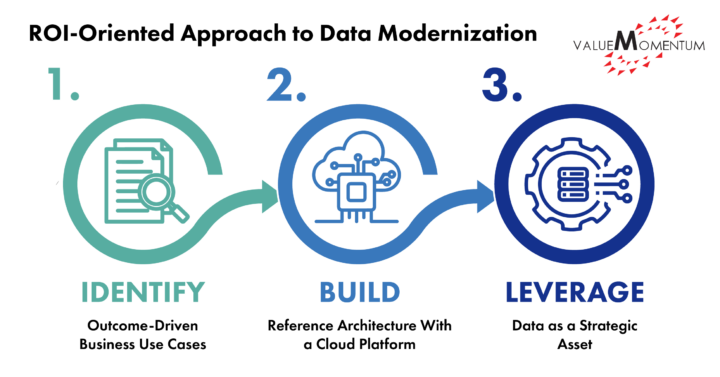

ROI-Oriented Approach to Data Modernization

An ROI-oriented data modernization approach emphasizes specific product outcomes over project goals, utilizes the latest insurance technology, and centers reusability at its core. This three-step approach is about understanding what to prioritize and where to funnel resources as needed to build and develop capabilities incrementally to support the data needs of the business as it grows.

-

Identify Outcome-Driven Business Use Cases

Identifying high-ROI use cases is the first step to pinpoint where data can immediately transfer into actionable insights. Key to this step is to flesh out where data analytics and its respective tools directly impact core insurance functionalities. Use cases can include improving operational efficiencies via non-financial data analysis or revamping a user access portal through customer data. Insurers must become outcome- and product-driven from the get-go to aim for a long-term modernization journey.

-

Build a Reference Architecture with a Cloud Platform

Cloud platforms—such as Snowflake—provides technology tools that are essential to build a reference architecture that leverages the cloud native capabilities of the platform. A proper modern cloud platform will help insurers transition away from on-premise legacy applications to a data platform that automatically standardizes varied data sets in one location. A cloud data platform implementation will require its own extensive journey, but understanding and leveraging third-party apps and tools will lead insurers to build robust data pipelines and scale analytics faster.

-

Leverage Data as a Strategic Asset

Insurers should identify reusable data products and patterns to derive long-term value for the business. As a larger goal, data must be treated as a strategic asset to democratize data utilization across the full insurance value chain. Finding reusable data sets will be the first step to standardize the data ecosystem across business units and drive adaptability. Ultimately, insurers need a flexible data platform that can adapt to changing business needs and empower ecosystem access.The ROI-oriented approach clarifies the underpinning assumptions that insurers must align the data strategy to the business strategy before taking the step of data modernization. Once insurers have a clear blueprint and an understanding of how to leverage data to drive their business goal via the platform, they can then advance in the technical direction of their data modernization journey.

Driving Insurance Insights with Data

Insurers’ goals are clear—they want faster claims processing, improved pricing and underwriting, personalized sales and customer services, ecosystem integration, and more. At its foundation is a solid modernized data platform, one that can support and accelerate new business goals. Along with an ROI-oriented approach that focuses the data modernization journey on the key principles to derive insight from data, a technology provider can further help insurers tackle data challenges and actualize their roadmap to a value-driven data platform.

Ready to jumpstart your data modernization journey to become a data-driven insurer? ValueMomentum offers a data maturity assessment and a Snowflake proof of value to clients and prospects looking to move to a cloud data platform. Check out our Data Platform Modernization Services to learn more about how we can help you get started.