For commercial insurance, agents play a critical role in providing businesses with high-value guidance and piecing together the products and services that meet their specific needs. Consequently, considering agents’ digital experience is essential for insurers intent on growing their commercial insurance business. To make it easier for agents to sell, access information, and quote and bind business, many are building API integrations that allow information to flow securely, efficiently, and seamlessly from core systems to agency management systems (AMS) and agent portals.

Integration with agency platforms, such as Ivans and Bold Penguin, is quickly becoming a distribution strategy for insurers looking to improve current distribution models and expand into new ones. To set themselves up for partner expansion, insurers are now building an API foundation that enables them not only to meet present needs but also to rapidly integrate with additional distribution channels in the future.

Here, we follow one insurer’s journey to capitalize on API capabilities. This property and casualty carrier’s immediate goal was to improve the quote process for its independent agents. Its long-term goal was to establish an API foundation that will allow the company to expand its partner ecosystem to drive business growth.

One Insurer’s Journey to Improve its Agents’ Digital Experience

A large P&C carrier that sells its insurance products exclusively through independent agents set out to improve its agent digital experience. Aware that ease of use is a key differentiator for winning and retaining agent business, the insurer’s first priority in its digitization project was to leverage APIs to empower its agents to access the information they needed to deliver quotes to customers promptly.

Without direct access to the insurer’s policy system and integration with functional capabilities, agents navigated an inefficient, manual process to retrieve quotes for customers. They would have to first take in the customer’s information, render in the format required by the carrier, and then push the information through to get a quote. The process took at least a day to complete, which was frustrating for agents who could not give customers the answers they wanted in a timely manner.

The delay was due to the absence of seamless integration between the carrier’s core system and the agency management platform. As agents requested a solution, the insurer set out to retain its central distribution channel by resolving their primary technical hurdle: its existing architecture and the API functionality required for integration.

Building the Foundation for Immediate and Long-Term Needs

Its immediate goal was to expose the relevant APIs to the agency platform while preventing specific APIs it relied on internally from being shared. It wanted to be certain that the integration would not give access to the APIs that enable a quote in its system, including customer account creation, risk and appetite assessment, as well as its core platform APIs.

The insurer also had the long-term vision to achieve an integrated distribution ecosystem that would allow it to capitalize on the capabilities of microservices, automation, and API management. With that end in mind, it set out to build the foundation and the APIs required for the integration demanded by its agents.

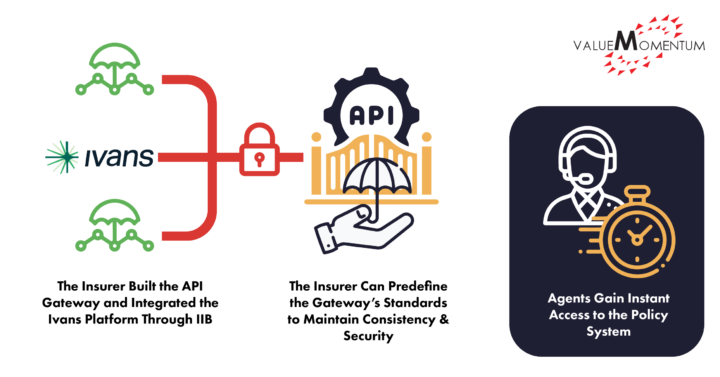

The insurer built a strategy to create an API gateway layer to help orchestrate all of its APIs to create single point of entry for integrators. It then turned to its IT services partner, ValueMomentum, to help implement its predefined strategy and build the API gateway. The goal was to first integrate with the Ivans platform and then build upon the API foundation for incremental integration with additional insurtechs.

Building the API gateway and integrating the Ivans platform through IIB gave agents instant access to the policy system. As a result, agents are now able to run quoting and rating through the orchestrated flow established for the carrier’s services. With the gateway managing the governance, the insurer could predefine the standards to maintain consistency and security while streamlining real-time data access.

The API platform eliminated the delay agents encountered when attempting to deliver a quote to a customer. Integration consolidated data access and accelerated quote generation for agents, reducing the initial turnaround time from a whole day to just a few minutes. This enhanced agent experience has enabled agents to quote and sell more policies to meet the business goal set for this phase of the API implementation.

Digital Platform for an Efficient Future

From this sustainable API foundation, the insurer now aims to utilize automation to further streamline their API gateway. The insurer also plans to leverage API management tools to govern and scale API development as it expands its partner ecosystem. This insurer’s approach exemplifies the sustainable API strategy that forward-looking insurers are embracing to enable growth.

As insurers expand their partnerships and distribution channels, a sound API platform will support both their short and long-term goals for digital distribution. Leveraging API management tools and automation will be driving factors for success in this API platform. Strategic insurers are now investing in these tools to deliver efficient data access and enhanced customer experiences, both of which are critical to driving growth in a digital era.

Learn more about how we can help you expand digital distribution and drive growth with APIs by visiting our Integration Services.